Apple Card Savings Account, a new high-yield savings account launched two weeks ago, has reportedly garnered an impressive $1 billion in deposits within just four days. Forbes reported that the account drew $400 million in deposits on its launch day and that the total rose to nearly $1 billion in deposits over the next three days. The report also stated that over 240,000 accounts were opened by the end of launch week, with an average balance of just over $4,000.

These numbers are significant, especially considering that the account is only available to Apple Card users. It is also noteworthy in the current financial climate, where financial institutions are fiercely competing to attract and retain deposits following multiple bank failures.

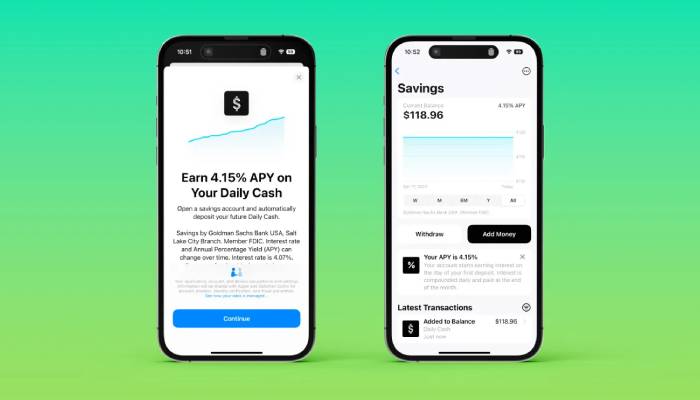

Apple Card Savings Account is operated by Goldman Sachs, which also partners with Apple on the Apple Card. The account pays an impressive 4.15% interest rate, significantly higher than the industry average. Apple and Goldman Sachs have declined to comment on these numbers, but it is possible that Goldman Sachs may release more information about the account when it files its earnings report and associated regulatory documents. However, it is unlikely that Apple will reveal any specific details about the account’s performance.